Digital strategists, me included, frequently tout the advantages of being a first mover. The general idea is that an early mover (not strictly the first mover) is able to leverage its lead to distance itself from the competition. An oft-cited example is search engine company Google. Once Google established itself as the market leader through a demonstrably better algorithm (page rank), than say Yahoo, when first launched, it became the beneficiary of network effects: more searches and therefore, more and better data, which led to better search results, which then made it difficult to dislodge. Let’s not forget that there were many other search engines – Yahoo, Lycos, Alta Vista, Excite, and others – when Google launched its product. In the early stages, when the market had not achieved anything remotely resembling steady-state, it was more of a free-for-all.

At today’s level of search engine maturity, better data is more important than the search algorithm itself.

%

DuckDuckGo

%

Bing

%

Current market share in the US. Competitors like Bing or DuckDuckGo are floundering.

Early mover advantage begins to kick in when one of the pioneers has a substantially better product than its competitors, develops a lead and exploits network effects to win even bigger. It’s also the case that economies of scale kick in. Any enhancement that a software company makes is amortized over its user base, so larger companies capture larger benefits from investment in their product. As an aside, it’s also been said that if a competitor develops a lead due to dumb luck rather than technological superiority, it can exploit its lead to grow the distance between it and its competitors, but luck cannot be the basis of a strategy.

How does first-mover advantage, seen so clearly in digital products, carry over to the world of physical products that are becoming digital – like autonomous vehicles? Unlike digital products where steady-state is characterized by a small number of players, physical product markets have many players. There are well over 60 auto brands globally. We’re seeing different strategies play out.

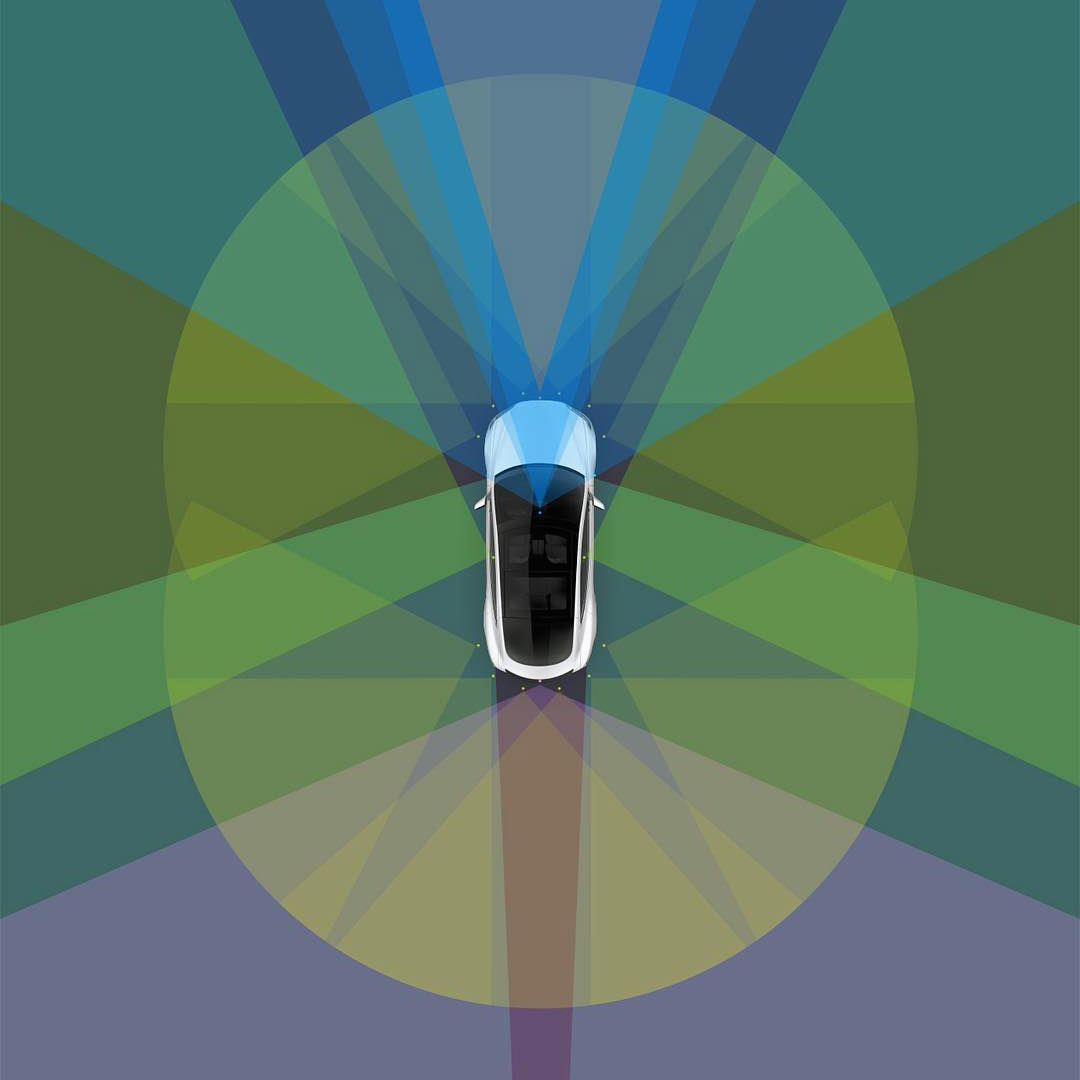

Alphabet’s Waymo division is widely recognized as the leader in fully autonomous cars, with substantially more hours of road-testing than its competitors. It hasn’t launched a commercial product yet though it is actively partnering with car companies. Tesla was the first to enter the autonomous driving market by allowing customers to download its self-driving software capability, Autopilot, to its Model S. Autopilot offers what is known as Level 2 autonomy (Level 5 is full autonomy) where the driver still maintains responsibility for tactical maneuvers. In contrast, Waymo believes that cars that rely on humans to take control when the autonomous software is unsure of how to react is the wrong approach. GM appears to have catapulted itself from a laggard to leader, planning to make fully autonomous vehicles available in 2019 in at least one American city. It did so with a vertically integrated strategy, acquiring self-driving software firm Cruise Automation for a sweet $1B and lidar manufacturer Strobe. And Ford has said that it expects to produce fully autonomous cars in 2021. Regardless of specific strategy, all these companies are racing to launch fast.

What then to make of auto industry giant Toyota, which sells almost 9 million cars annually and has chosen a slower, more cautious strategy? They are taking the approach of first making cars safer and more enjoyable for humans to drive. They plan to acquire map data, essential to self-driving software, by equipping cars that they will sell to consumers with cameras and radars that will train the software according to an article in The Economist.

My instinctive reaction when I read the article was negative. I thought: here is yet another company that refuses to recognize the new digital reality. But then, as I reflected further, I came to a different conclusion because each company’s autonomous vehicle strategy depends on that company’s market position. For Waymo, it makes sense to push aggressively. It is a software company and is focused on self-driving software. Waymo believes that cars that rely on humans to take control when the autonomous software is unsure of how to react is the wrong approach. They will develop the software for Level 5 autonomy and are unlikely to get into auto manufacturing, instead choosing to partner. With this approach, they need to be best and early, just like in search.

Tesla, as a newer car company, has built in hardware platforms into all of its cars, and is not a volume manufacturer yet. Their customer base values technological innovation; it is part of their value proposition. They need to continue steadily along the path of autonomy, but I’d be surprised if many of their customers are buying Teslas primarily for Autopilot.

In contrast, Toyota’s bet is that self-driving cars are too far in the future, that there are too many unseen forks in the road, and you can waste a lot of money in the process, while not gaining many sales. There are more than 1.3 billion cars in the world today, virtually none of which have any self-driving capability. Since the average life of a car is around 11 years, and given that the cost of a car is the second biggest or biggest expense that people incur, it’s going to be decades before self-driving cars are even a majority of the installed base.

Network effects, which are the driver of first mover advantage in software, are also a barrier in the short run. Until many cars have vehicle-to-vehicle communication and the digital infrastructure for roads is built up, we’re not going to be able to capture all of the benefits. And I don’t see consumers rushing to replace a newer model car because they want autonomous driving capability.

Moreover, Toyota is a global brand and self-driving cars are much further away in developing countries than in the developed world. I like to joke that in India, self-driving cars will never work because they are programmed not to move when there is a person or a car a foot or two in front of them, which is always the case in an Indian metropolis.

Toyota is choosing to improve their existing, saleable products by making their current cars safer and easier to drive. Which one of us doesn’t want an AI assisted car, which brakes when we are too slow to do so, or to drive for us in stop-and-go traffic? With an aging population in so many countries, this is smart. The major risk with this strategy is if somehow self-driving cars are adopted faster than anyone imagined and Toyota can’t get on the bandwagon in time. This would certainly be a problem if the company was ignoring self-driving altogether, but they aren’t. Toyota has invested substantially in developing self-driving capabilities at Toyota Research Institute. They need to be investing in building a capability that they can incorporate in their cars in short order once the trend becomes clearer.

Let’s not forget that Toyota has an extremely large number of loyal customers, who respect the company for giving them high-quality cars at attractive prices. As long as Toyota maintains readiness for self-driving cars, it has the luxury of time.

An important question is whether consumers or fleets will buy a particular car because it has the best self-driving software or whether the capability will be a commodity. There’s no question that self-driving software will be commercially available from a software company or even a failed auto manufacturer; it’s available even now for enthusiasts. I predict that like safety features, some companies will acquire a reputation for the “best” self-driving cars.

Digital transformation is challenging. It’s important to develop a vision of the future and a strategy to get there. But it’s also about having the courage to make big investments in digital capabilities at the right time.

Perhaps it’s not always best to be first?

Recent Posts

What Gartner’s $4.4 Trillion IT Spending Forecast Tells Us: It’s A Software Economy

Worldwide IT spending in 2022 is poised to exceed $4.4 trillion, an increase of 4% over 2021, even after growing at the torrid pace of 9.5% the year before. When the pandemic first hit in early 2020, unsure about the business implications, CIOs pulled back...

What GitLab’s $11 Billion IPO Says About In House Software Development: Iterate To Innovate

On October 14, GitLab, a ten-year old coding platform company with just 1,350 employees, went public at a valuation of $11 billion. Just over two weeks later, the stock is up over 50%, giving the company a market capitalization of $17 billion. This valuation is for a...

CIOs: Apply These Lessons From The Pandemic To Win The Recovery

The Bureau of Economic Analysis announced on July 29, 2021 that real economic output of the US grew at an annual rate of 6.5% in the second quarter. Following on the heels of a strong first quarter, US GDP has exceeded its pre-pandemic levels in remarkably short...